Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

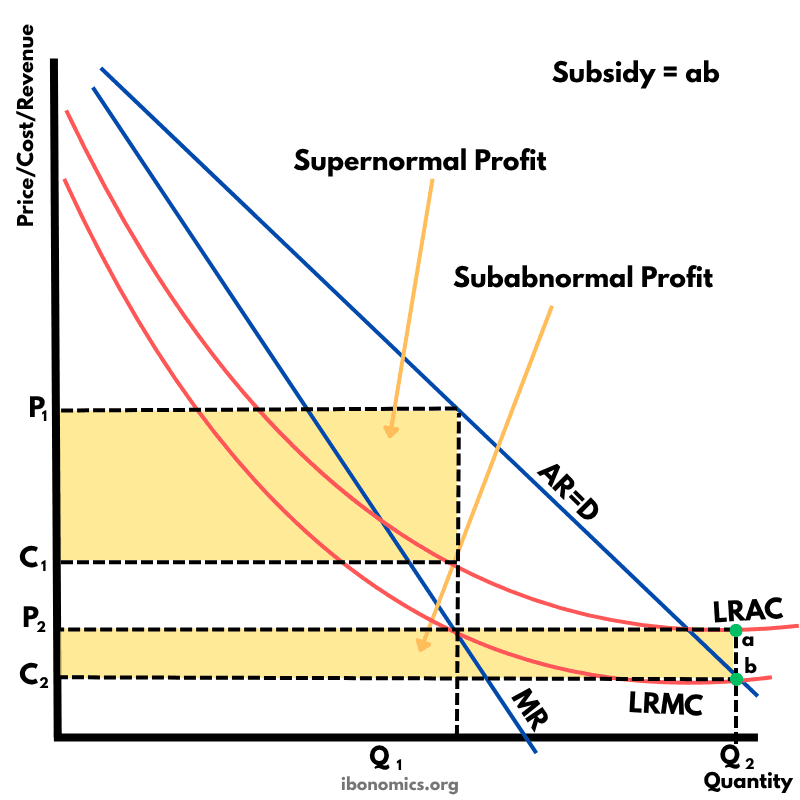

A diagram illustrating a natural monopoly regulated to achieve allocative efficiency through subsidies. It highlights supernormal and subabnormal profit regions, along with the required subsidy to sustain production at the socially optimal quantity.

AR = D: The average revenue or demand curve, downward sloping.

MR: Marginal revenue curve, lies below AR due to price reduction on all units.

LRAC: Long-run average cost, continuously decreasing due to economies of scale.

LRMC: Long-run marginal cost, intersects MR at the profit-maximizing quantity.

Q1: Profit-maximizing output where MR = LRMC, yielding supernormal profit.

P1: Price charged at Q1, generating supernormal profit (area between P1 and C1).

C1: Cost per unit at Q1, based on LRAC.

Q2: Allocatively efficient output where AR = LRMC.

P2: Price consumers pay at Q2 under government regulation.

C2: Cost per unit at Q2, above the price, resulting in subnormal profit.

ab: Vertical distance representing the per-unit subsidy needed to cover the loss at Q2.

A natural monopoly arises when one firm can supply the entire market at a lower cost than multiple firms due to large economies of scale.

At Q1, the firm maximizes profit where marginal revenue (MR) intersects long-run marginal cost (LRMC), charging price P1 and enjoying supernormal profit (shaded area between P1 and C1).

Allocative efficiency occurs at Q2, where the price (P2) equals LRMC, but at this point, the firm incurs a subnormal profit since cost C2 exceeds price P2.

To sustain production at Q2, the government provides a subsidy equal to the vertical distance ab — the loss per unit that the firm would incur at the allocatively efficient level.

This type of regulation improves societal welfare by increasing output and lowering prices, despite requiring taxpayer funding to cover the firm's losses.

Explore other diagrams from the same unit to deepen your understanding

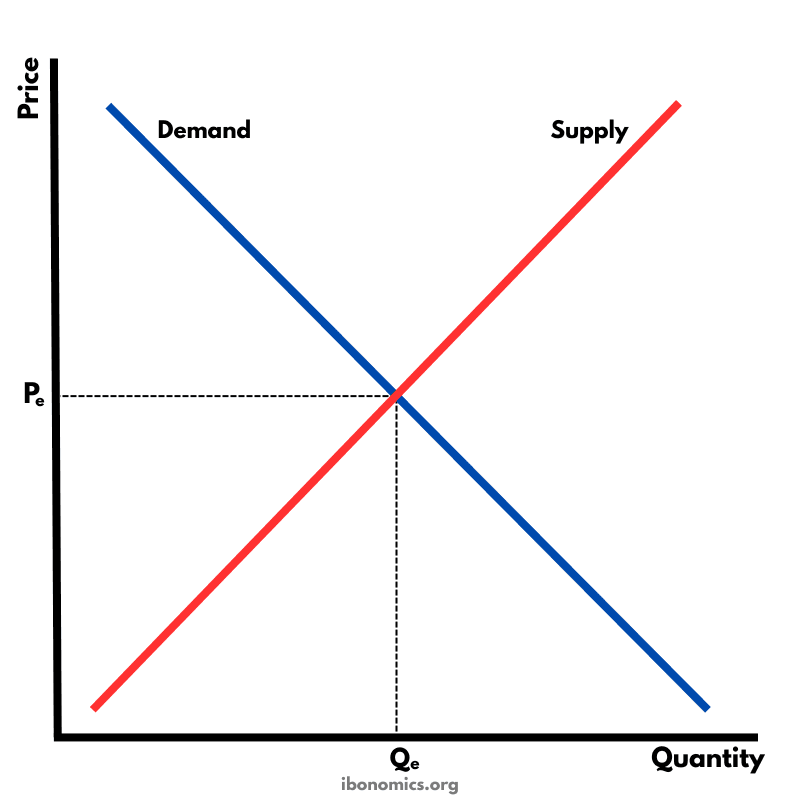

The fundamental diagram showing the relationship between demand and supply in a competitive market, determining equilibrium price and quantity.

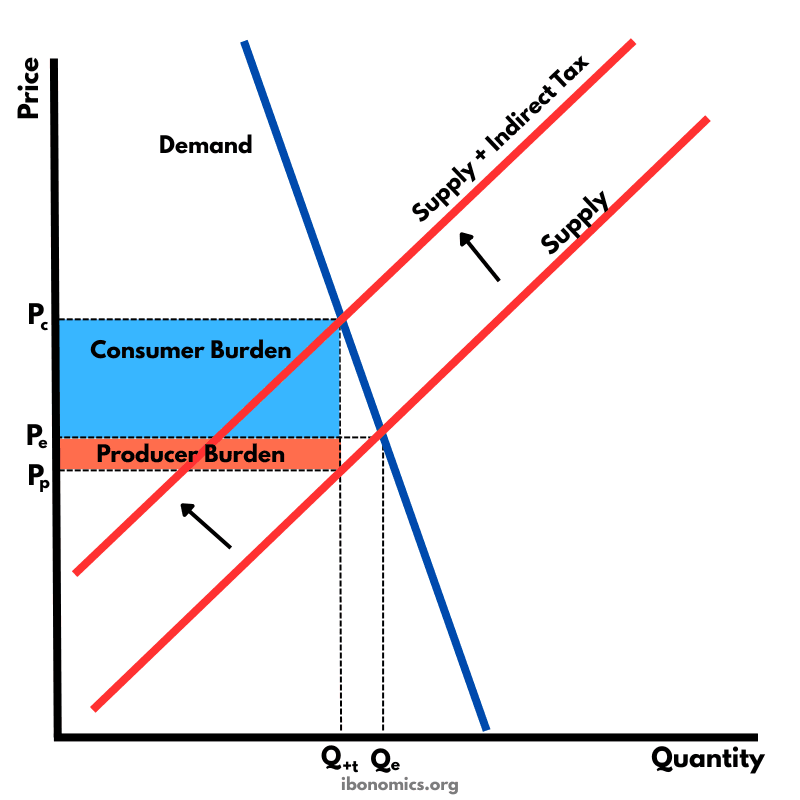

A supply and demand diagram showing the effect of an indirect tax on a good with inelastic demand. The consumer bears a larger share of the tax burden.

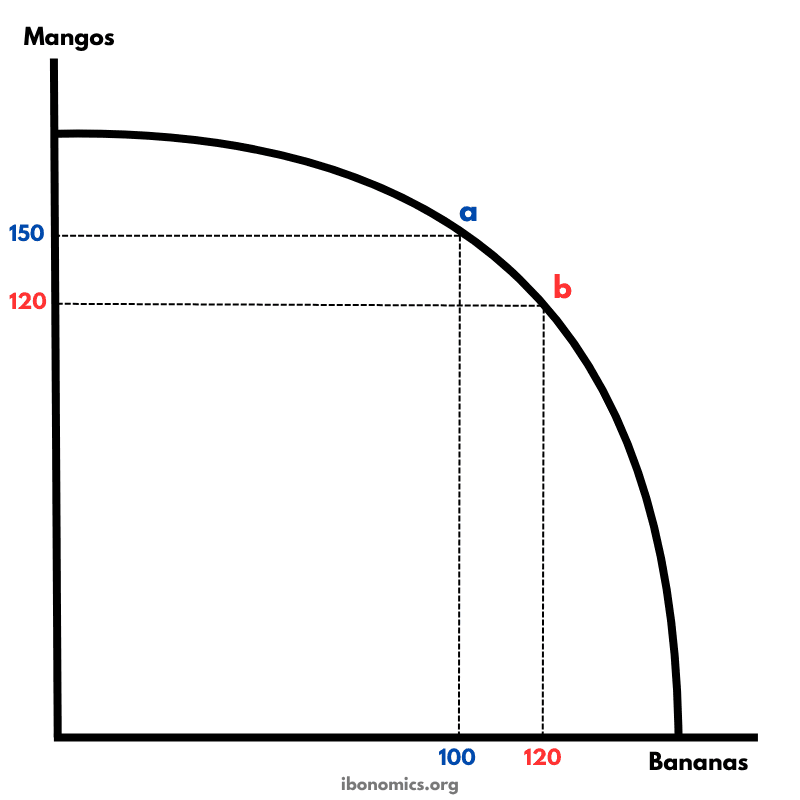

A production possibility curve illustrating the concept of opportunity cost and the trade-offs between producing two goods: mangos and bananas.

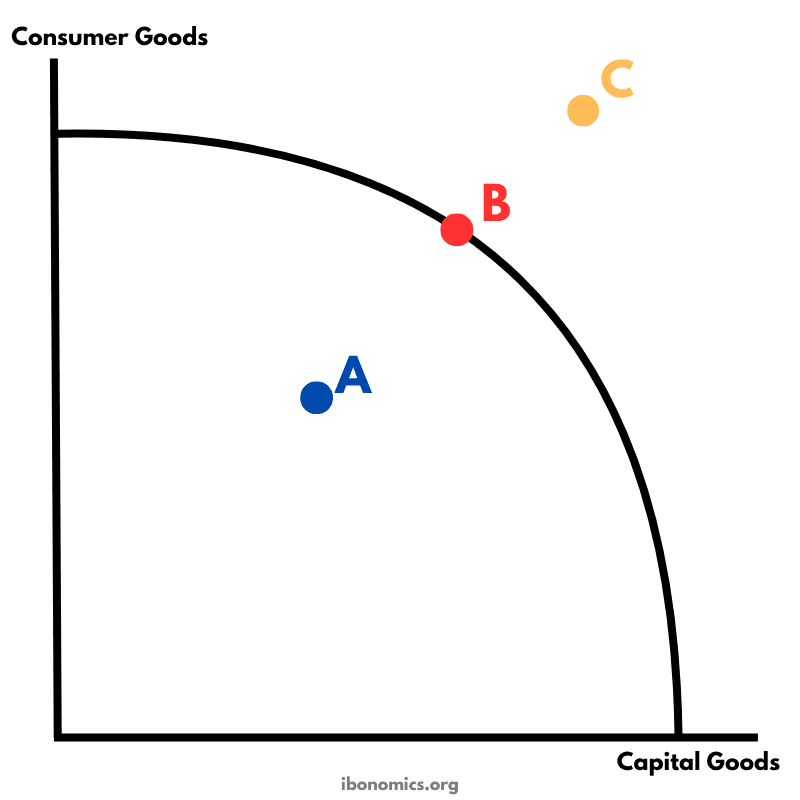

A PPC diagram showing different levels of production efficiency and economic feasibility using combinations of consumer and capital goods.

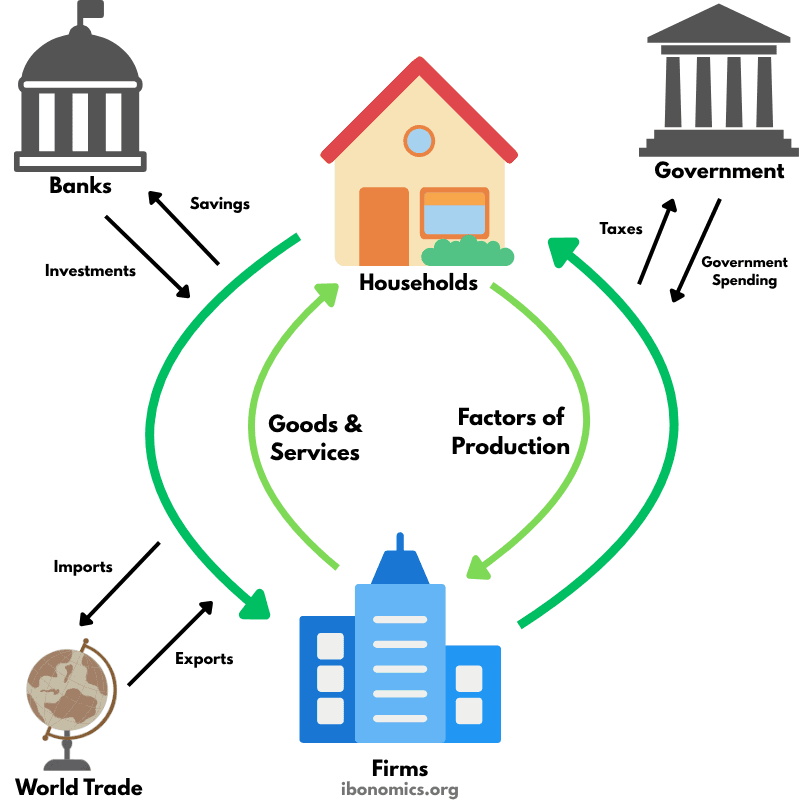

A model illustrating how money, goods, services, and resources flow between households, firms, the government, the financial sector, and the foreign sector in an economy.

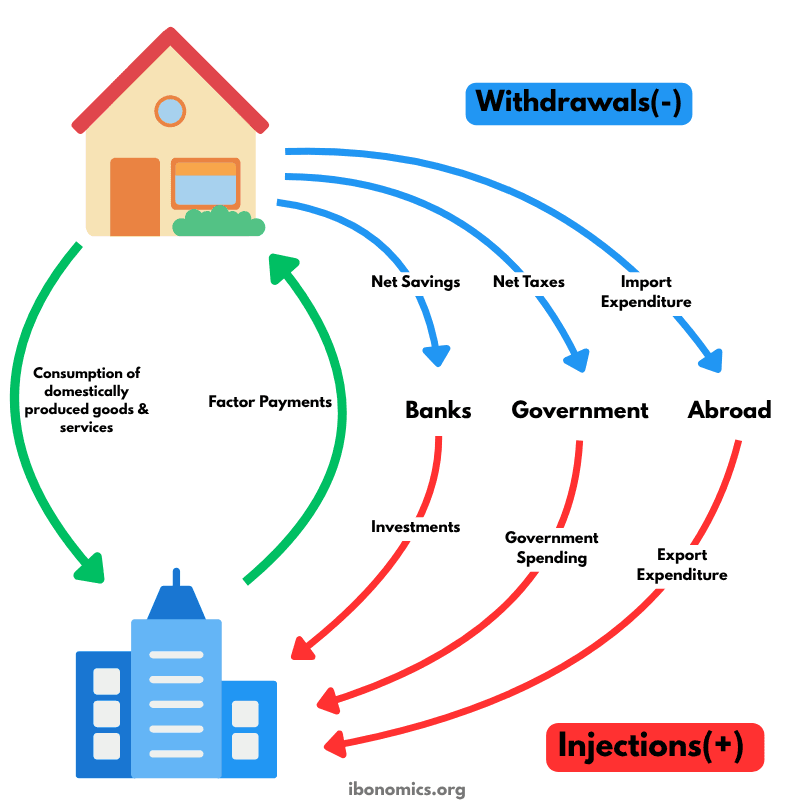

A refined circular flow model highlighting the roles of injections and withdrawals in determining national income and economic equilibrium.