Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

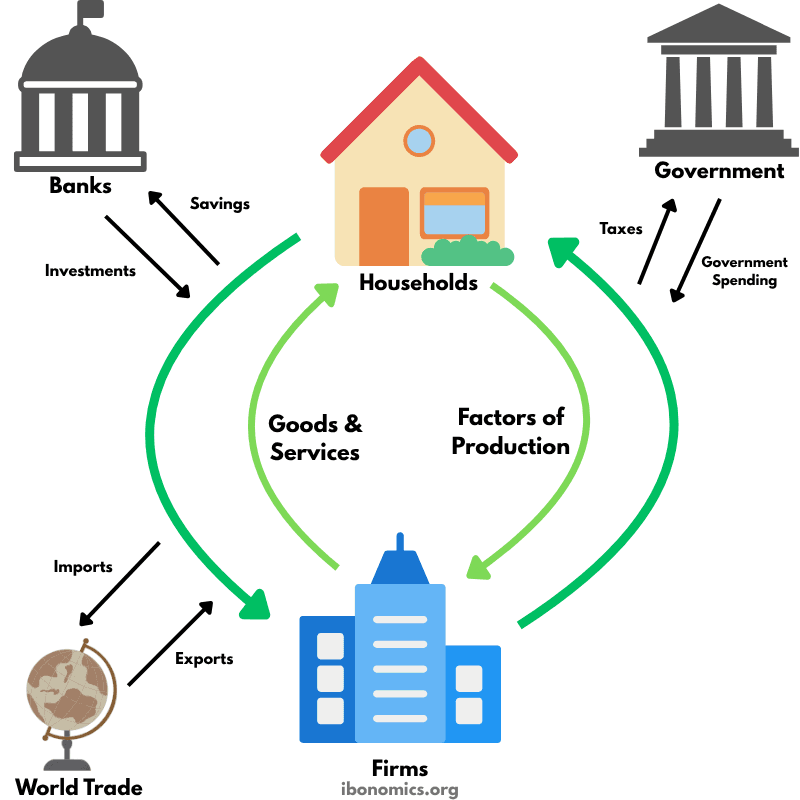

A model illustrating how money, goods, services, and resources flow between households, firms, the government, the financial sector, and the foreign sector in an economy.

Households: Provide factors of production and receive income. Use income to consume goods and services.

Firms: Produce goods and services using factors of production. Pay income to households and receive revenue from sales.

Government: Collects taxes and injects spending into the economy, influencing both households and firms.

Financial Sector (Banks): Facilitate savings and investments, linking households and firms.

Foreign Sector (World Trade): Introduces imports (leakages) and exports (injections), affecting the overall flow of income.

Households provide factors of production (land, labor, capital, and entrepreneurship) to firms and receive income in return.

Firms use these factors to produce goods and services, which they sell to households.

Households pay for these goods and services, creating a flow of consumer expenditure back to firms.

Savings from households go to banks, which provide investments back into the economy, especially to firms.

The government collects taxes from households and firms and injects money back into the economy through government spending.

International trade introduces imports (leakage) and exports (injection) into the circular flow through interactions with the global economy.

Explore other diagrams from the same unit to deepen your understanding

A diagram illustrating the fluctuations in real GDP over time, including periods of boom, recession, peak, and trough, relative to the long-term trend of economic growth.

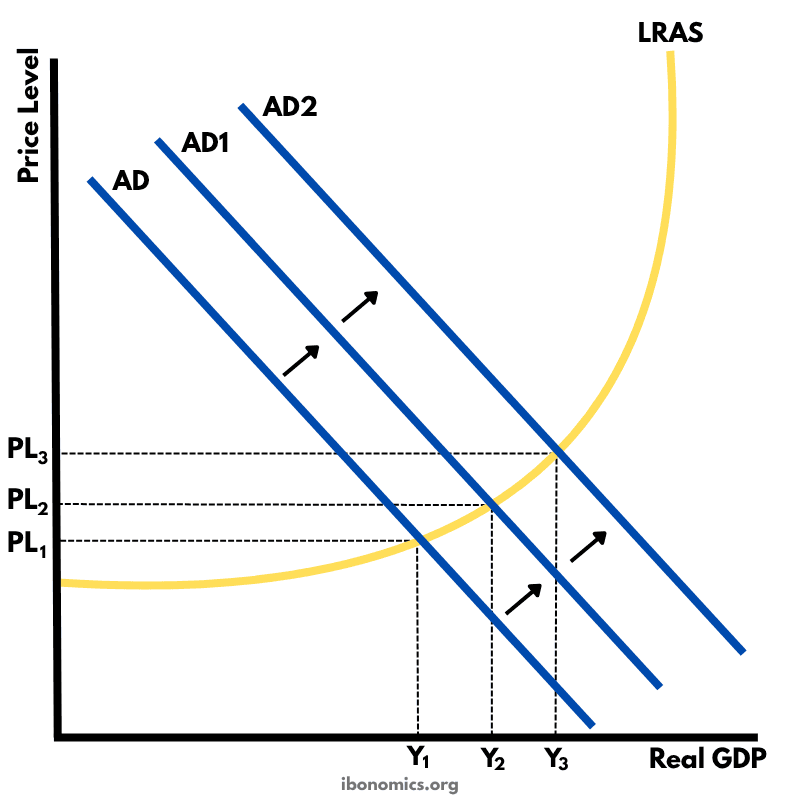

This diagram shows the intersection of the aggregate demand (AD) and short-run aggregate supply (AS) curves to determine the equilibrium price level and real GDP.

A diagram showing the Classical model of aggregate demand (AD), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS), used to explain long-run macroeconomic equilibrium.

A Keynesian aggregate demand and long-run aggregate supply (AD–LRAS) diagram showing how real GDP and the price level interact across different phases of the economy, including spare capacity and full employment.

A diagram showing an output (deflationary) gap, where the economy is producing below its full employment level of output (Ye).

This diagram shows how an initial increase in aggregate demand leads to a multiplied increase in national output (real GDP) and price level within the Keynesian framework.