Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

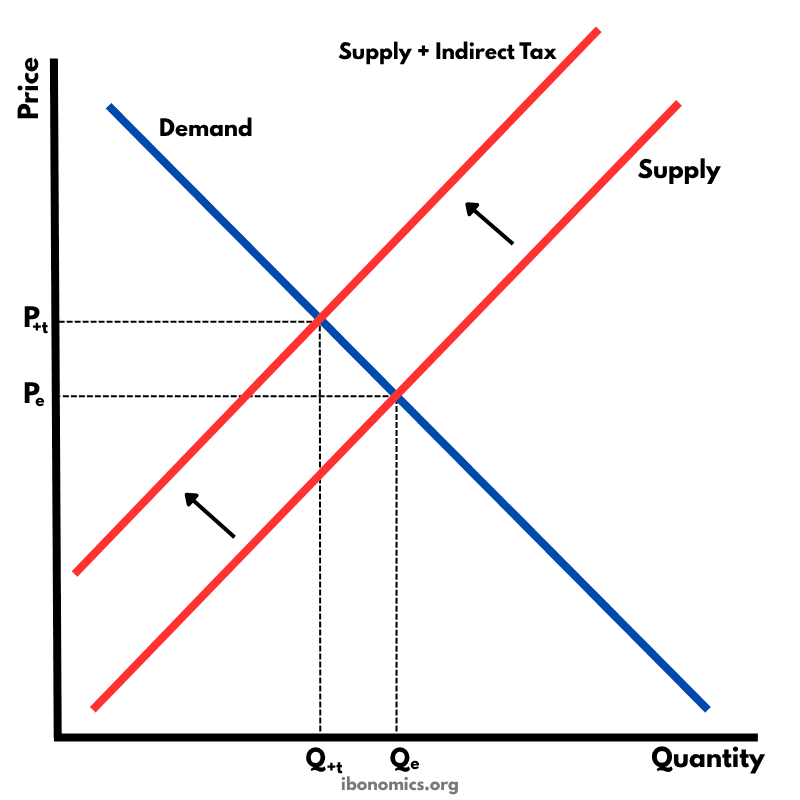

A diagram showing the effects of an indirect tax on a market, resulting in a leftward shift of the supply curve, higher price for consumers, lower quantity traded, and a reduction in market efficiency.

Demand Curve: Downward-sloping, showing the inverse relationship between price and quantity demanded.

Supply Curve: Upward-sloping, representing the pre-tax quantity producers are willing to supply at each price.

Supply + Indirect Tax: The new supply curve after a per-unit tax increases production costs.

Price Effect: Consumers face a higher price (P+t), depending on the tax incidence.

Quantity Effect: Quantity falls from Qe to Q+t, reducing market efficiency.

An indirect tax is a tax imposed on goods or services, typically paid by producers but passed on to consumers through higher prices.

The tax shifts the supply curve upward (or to the left), from 'Supply' to 'Supply + Indirect Tax'.

At the new equilibrium, the price consumers pay rises from Pe to P+t, while the quantity exchanged falls from Qe to Q+t.

The vertical distance between the original and new supply curves represents the tax per unit.

While indirect taxes raise government revenue and can help internalize externalities (e.g. cigarette or carbon taxes), they may also reduce consumer and producer surplus and cause welfare loss.

Explore other diagrams from the same unit to deepen your understanding

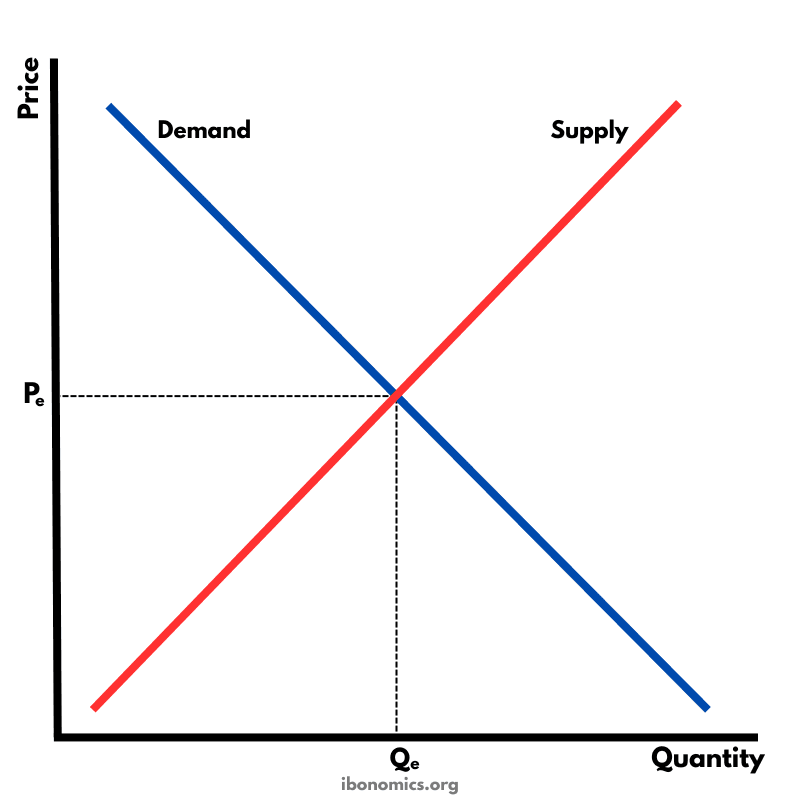

The fundamental diagram showing the relationship between demand and supply in a competitive market, determining equilibrium price and quantity.

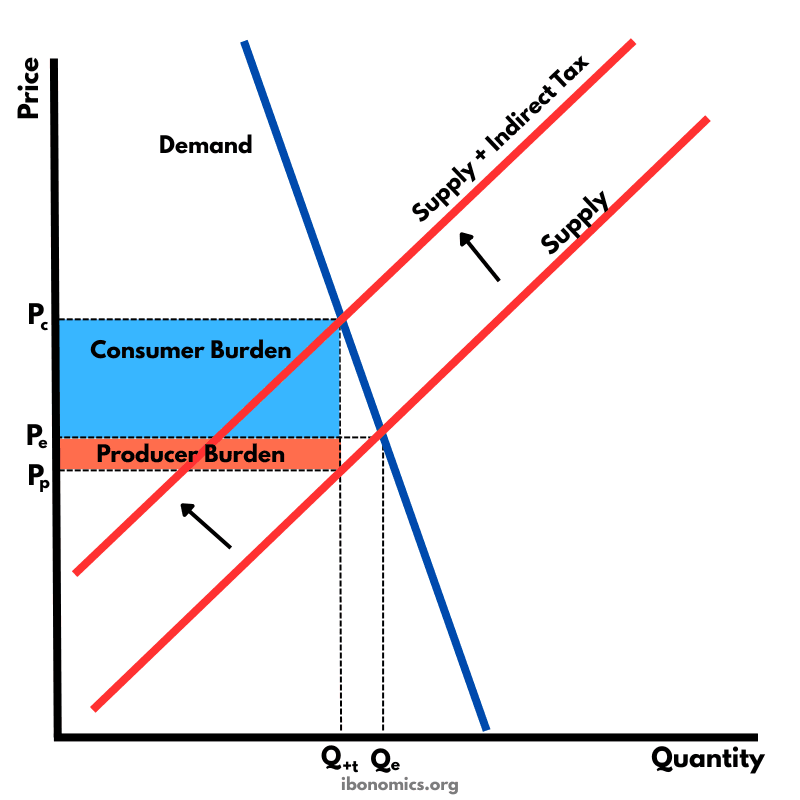

A supply and demand diagram showing the effect of an indirect tax on a good with inelastic demand. The consumer bears a larger share of the tax burden.

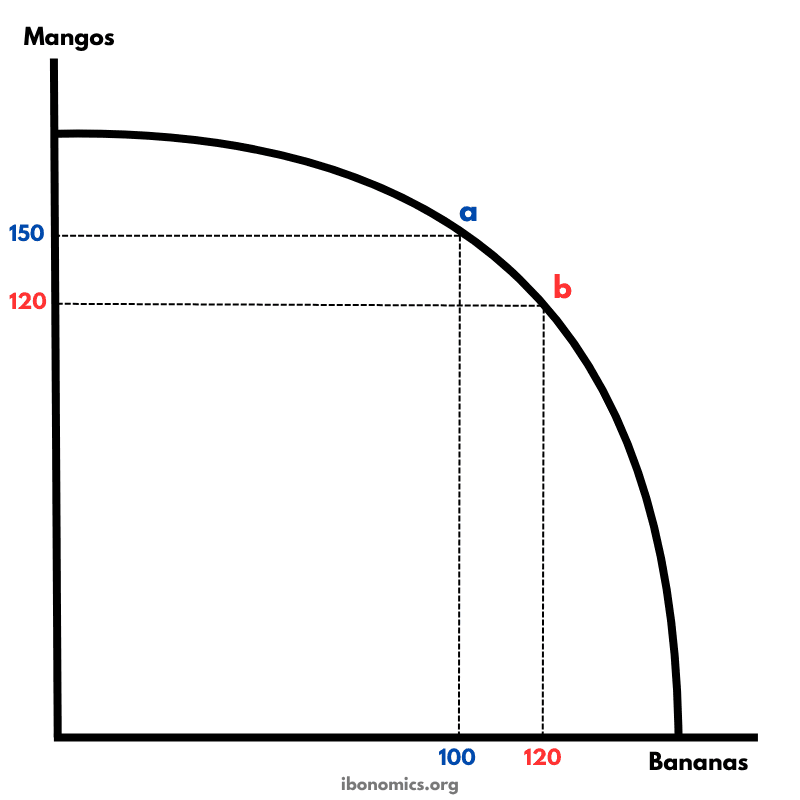

A production possibility curve illustrating the concept of opportunity cost and the trade-offs between producing two goods: mangos and bananas.

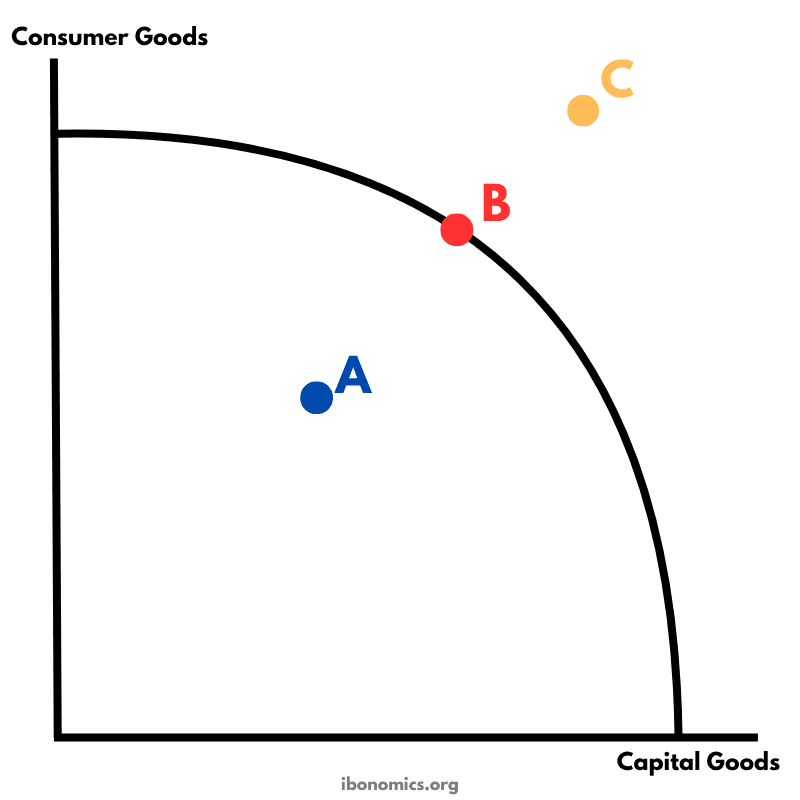

A PPC diagram showing different levels of production efficiency and economic feasibility using combinations of consumer and capital goods.

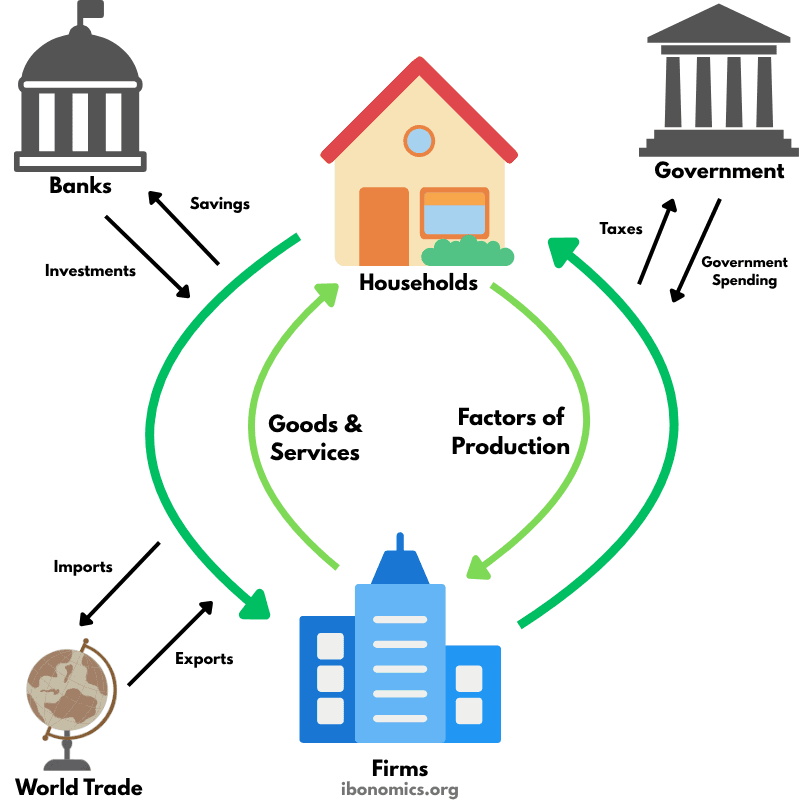

A model illustrating how money, goods, services, and resources flow between households, firms, the government, the financial sector, and the foreign sector in an economy.

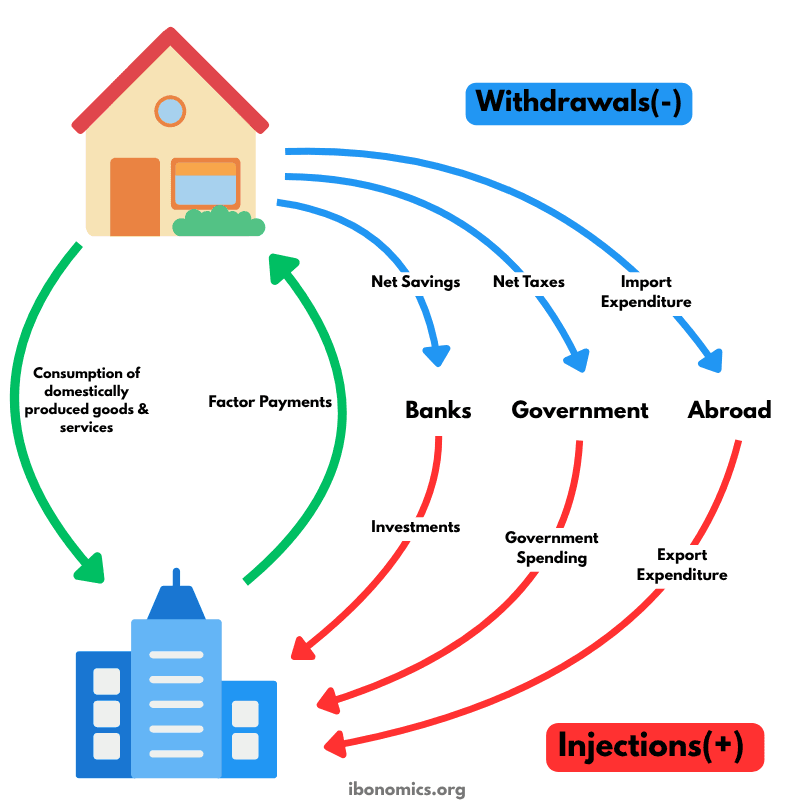

A refined circular flow model highlighting the roles of injections and withdrawals in determining national income and economic equilibrium.