Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

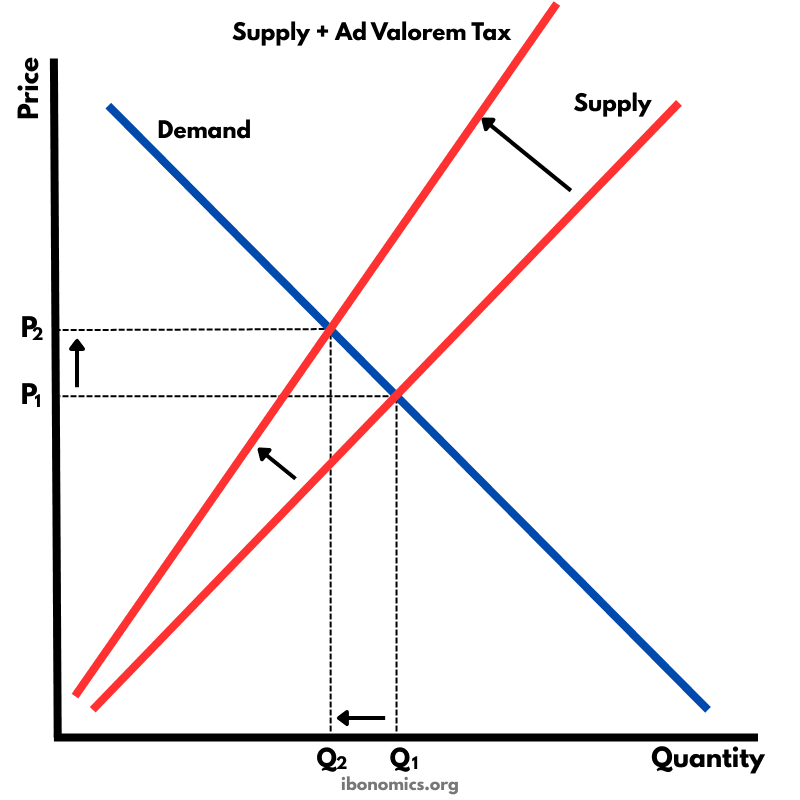

This diagram illustrates the effect of an ad valorem (percentage) tax on producers. Unlike a specific tax which shifts the supply curve upward in a parallel way, an ad valorem tax causes the supply curve to pivot and become steeper. As price rises, the tax amount increases proportionally, leading to a higher final price for consumers and a lower equilibrium quantity.

Demand: Downward-sloping curve showing consumer willingness to buy at different prices.

Original Supply: Producer costs before the tax.

Supply + Ad Valorem Tax: Rotated, steeper supply curve representing percentage-based tax.

P1: Original equilibrium price before the tax.

P2: Higher price paid by consumers after the tax.

Q1: Original equilibrium quantity before the tax.

Q2: Reduced equilibrium quantity due to the tax.

The original supply curve is shown on the right. Producers set price P1 at the initial equilibrium.

An ad valorem tax raises production costs by a percentage at every price level, causing the supply curve to rotate upward and become steeper.

The new equilibrium price increases from P1 to P2, meaning consumers pay more after the tax is imposed.

The equilibrium quantity falls to Q1, showing reduced output and consumption due to higher prices.

Because the tax is percentage-based, the gap between the old and new supply curves widens as the price increases.

Explore other diagrams from the same unit to deepen your understanding

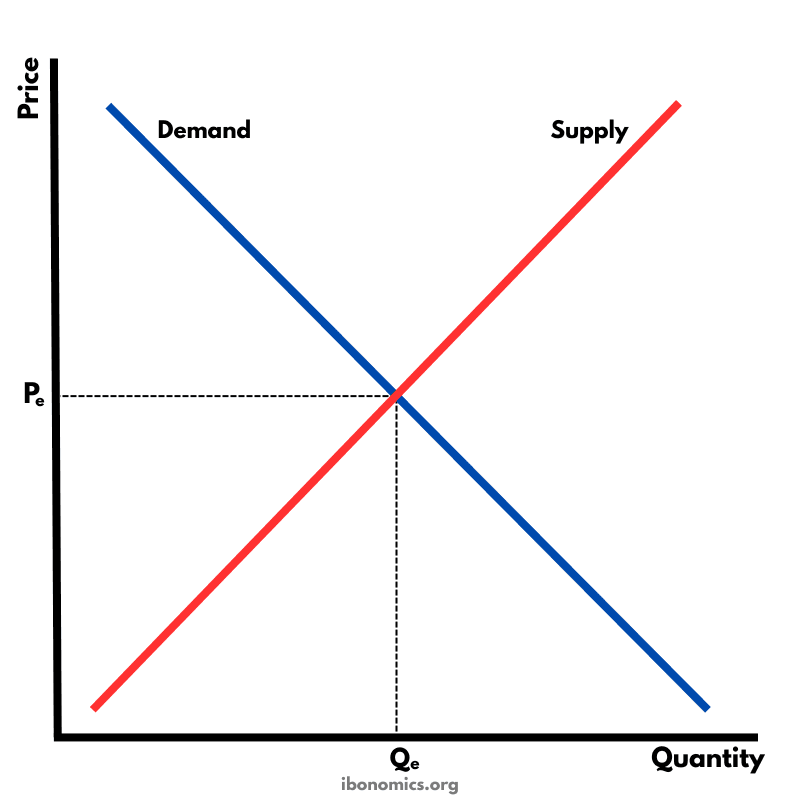

The fundamental diagram showing the relationship between demand and supply in a competitive market, determining equilibrium price and quantity.

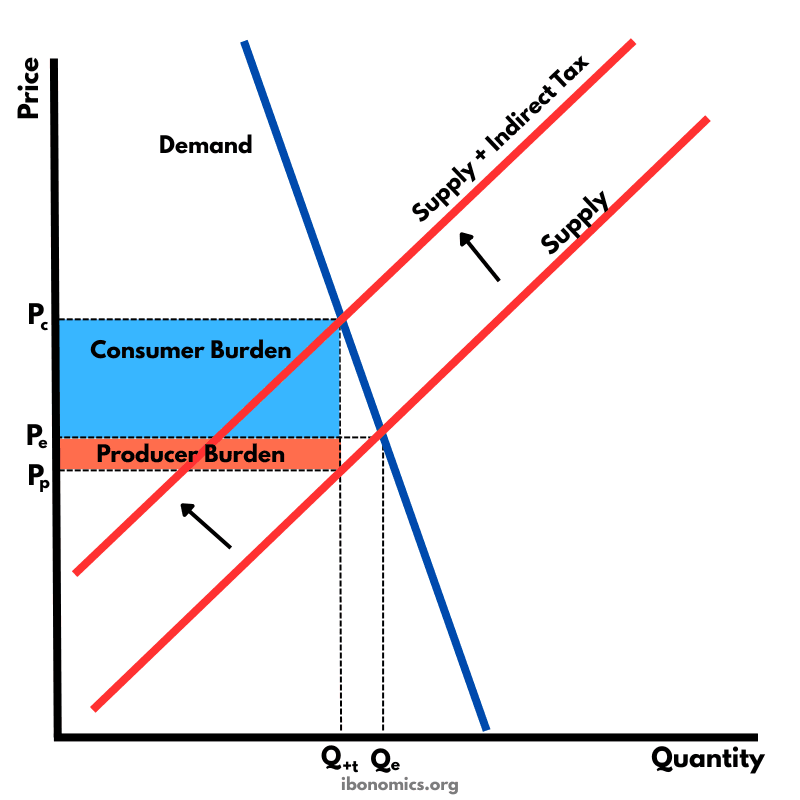

A supply and demand diagram showing the effect of an indirect tax on a good with inelastic demand. The consumer bears a larger share of the tax burden.

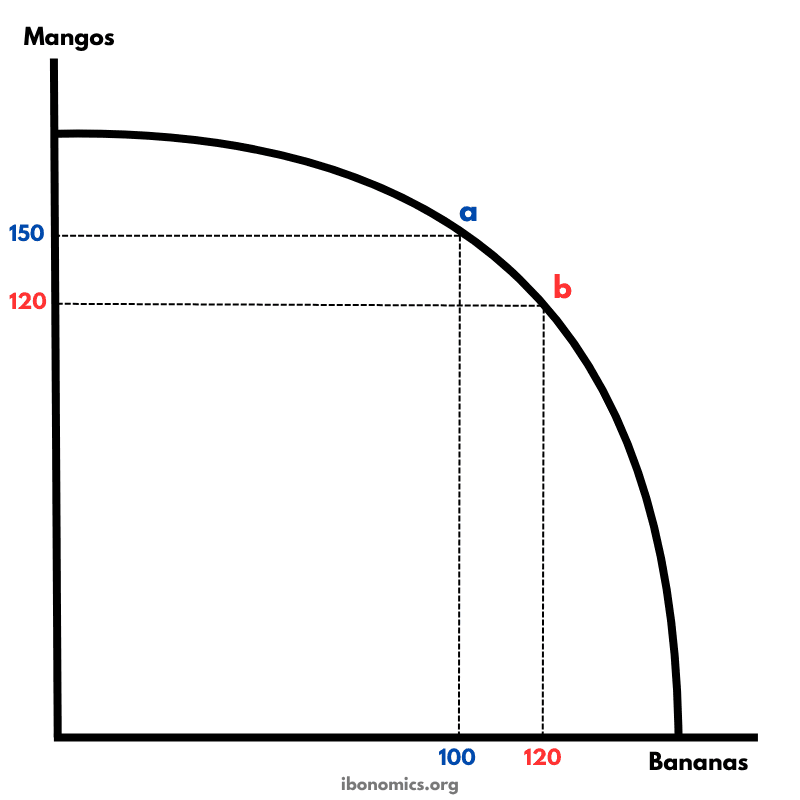

A production possibility curve illustrating the concept of opportunity cost and the trade-offs between producing two goods: mangos and bananas.

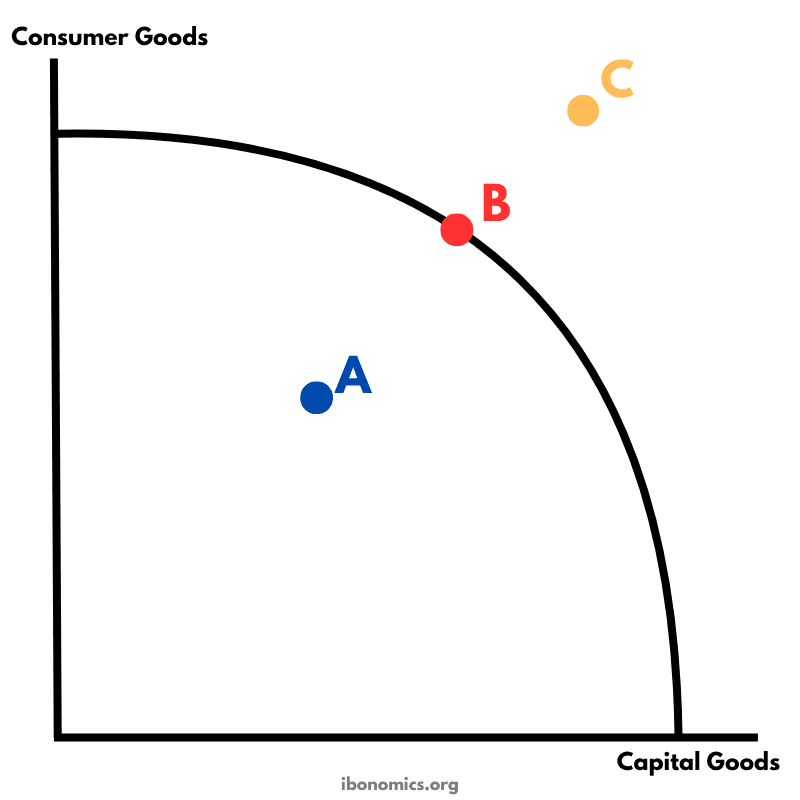

A PPC diagram showing different levels of production efficiency and economic feasibility using combinations of consumer and capital goods.

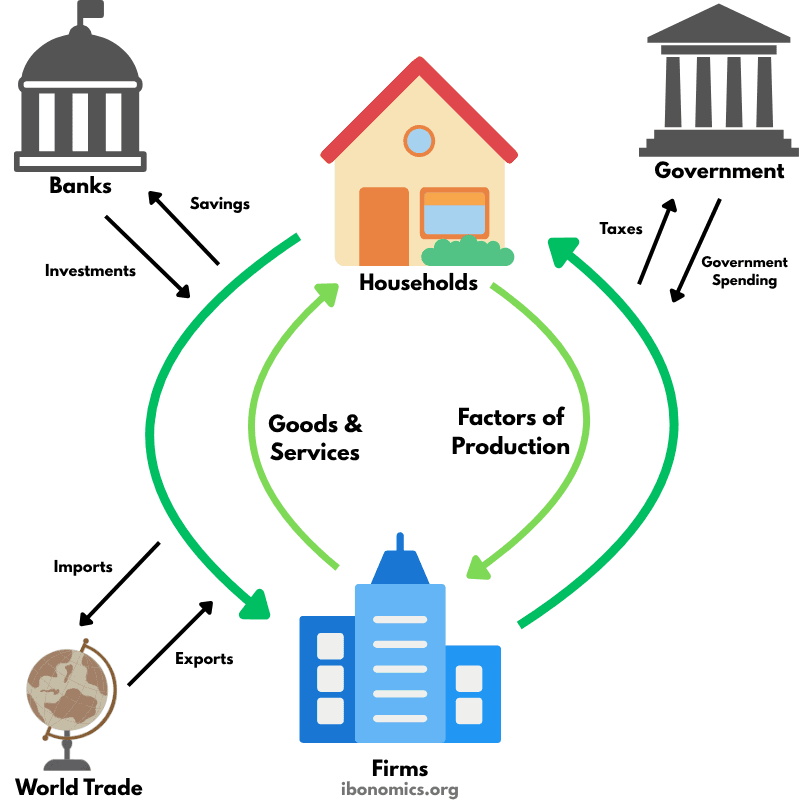

A model illustrating how money, goods, services, and resources flow between households, firms, the government, the financial sector, and the foreign sector in an economy.

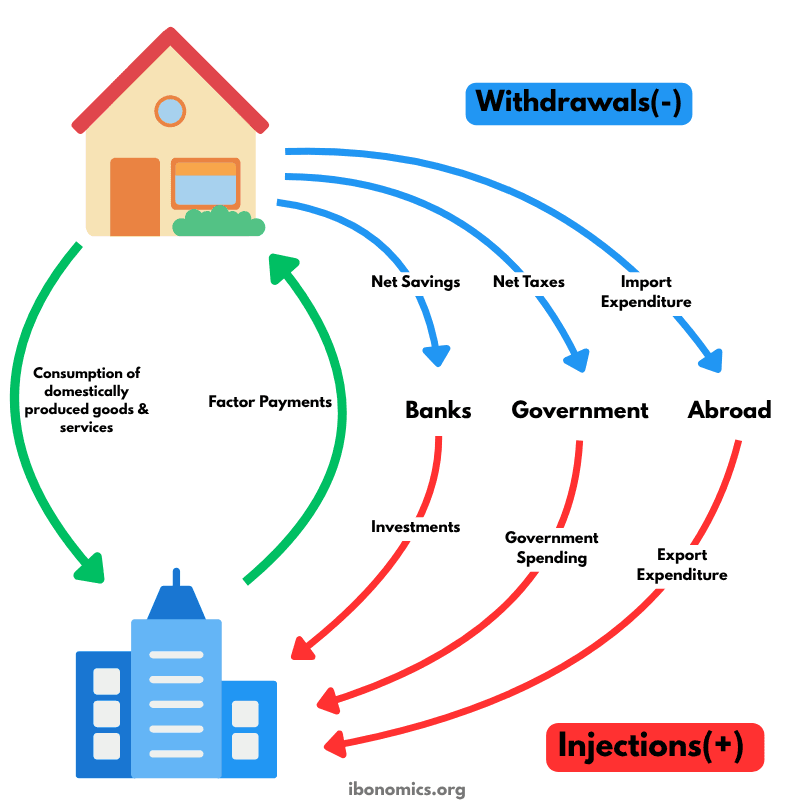

A refined circular flow model highlighting the roles of injections and withdrawals in determining national income and economic equilibrium.