Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

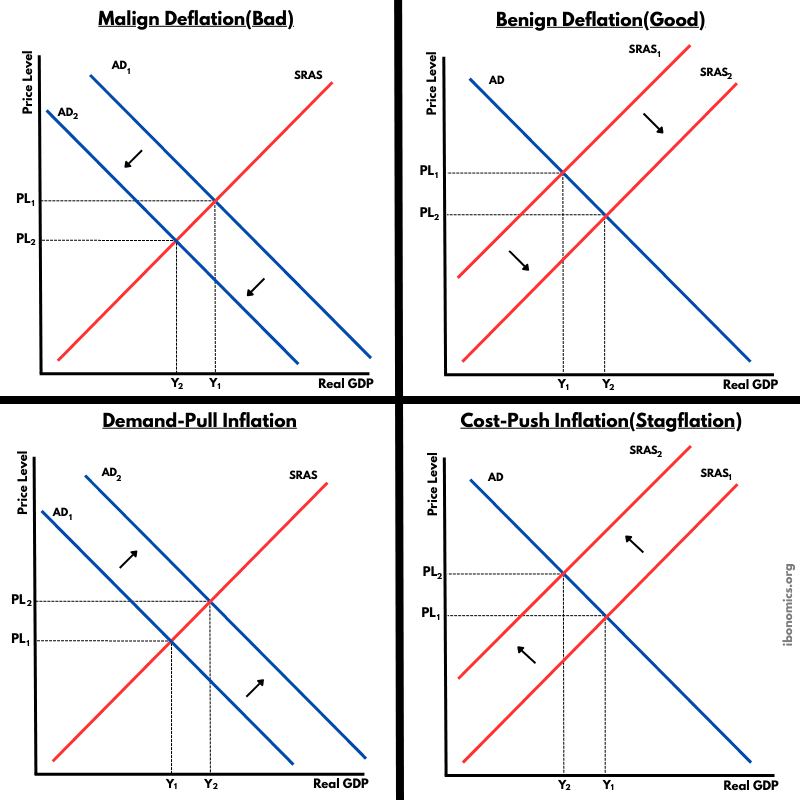

This four-panel diagram compares two types of inflation and two types of deflation using the AD and SRAS model. Demand-pull inflation is caused by an increase in aggregate demand. Cost-push inflation is caused by a decrease in short-run aggregate supply. Benign deflation occurs when short-run aggregate supply increases, lowering the price level while raising real output. Malign deflation occurs when aggregate demand falls, lowering the price level while reducing real output. Each panel shows how changes in AD or SRAS affect the price level and real GDP.

AD: Aggregate demand shows total spending on domestic output at different price levels. Shifts right increase the price level and real GDP. Shifts left reduce the price level and real GDP.

SRAS: Short-run aggregate supply shows real output produced at different price levels. Shifts right lower the price level and raise real GDP. Shifts left raise the price level and reduce real GDP.

Demand-pull inflation happens when aggregate demand increases from AD1 to AD2, causing the price level to rise and real GDP to increase. Potential cause: increased consumer spending due to lower interest rates.

Cost-push inflation happens when short-run aggregate supply decreases from SRAS1 to SRAS2, causing the price level to rise while real GDP falls. Potential cause: a rise in oil or energy prices that increases production costs.

Benign deflation happens when short-run aggregate supply increases from SRAS1 to SRAS2, causing the price level to fall while real GDP rises. Potential cause: productivity growth from improved technology.

Malign deflation happens when aggregate demand decreases from AD1 to AD2, causing the price level to fall while real GDP falls. Potential cause: a fall in consumer confidence leading to lower consumption and investment.

Explore other diagrams from the same unit to deepen your understanding

A diagram illustrating the fluctuations in real GDP over time, including periods of boom, recession, peak, and trough, relative to the long-term trend of economic growth.

This diagram shows the intersection of the aggregate demand (AD) and short-run aggregate supply (AS) curves to determine the equilibrium price level and real GDP.

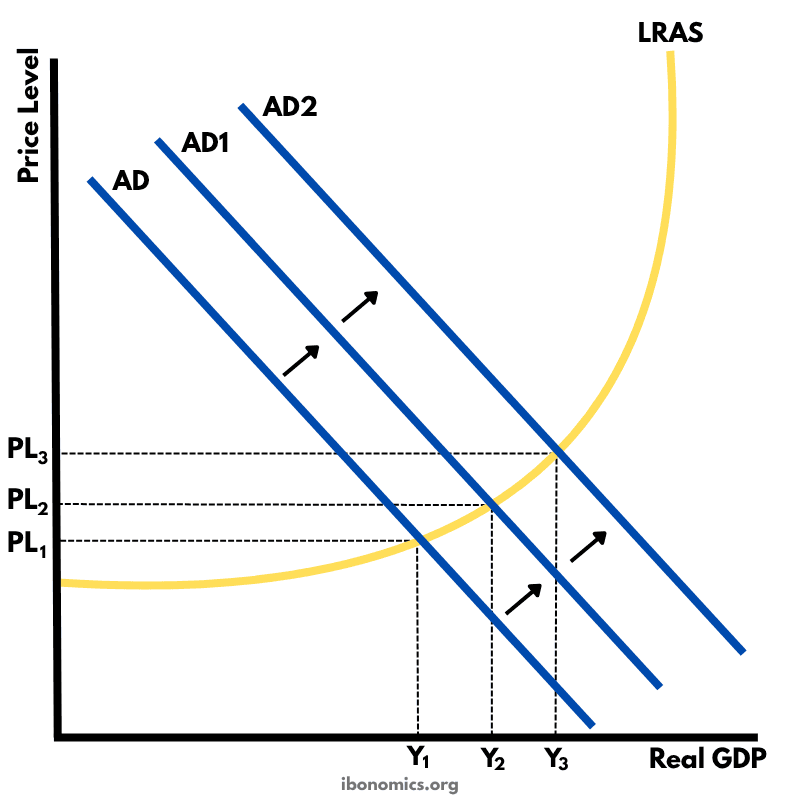

A diagram showing the Classical model of aggregate demand (AD), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS), used to explain long-run macroeconomic equilibrium.

A Keynesian aggregate demand and long-run aggregate supply (AD–LRAS) diagram showing how real GDP and the price level interact across different phases of the economy, including spare capacity and full employment.

A diagram showing an output (deflationary) gap, where the economy is producing below its full employment level of output (Ye).

This diagram shows how an initial increase in aggregate demand leads to a multiplied increase in national output (real GDP) and price level within the Keynesian framework.