Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

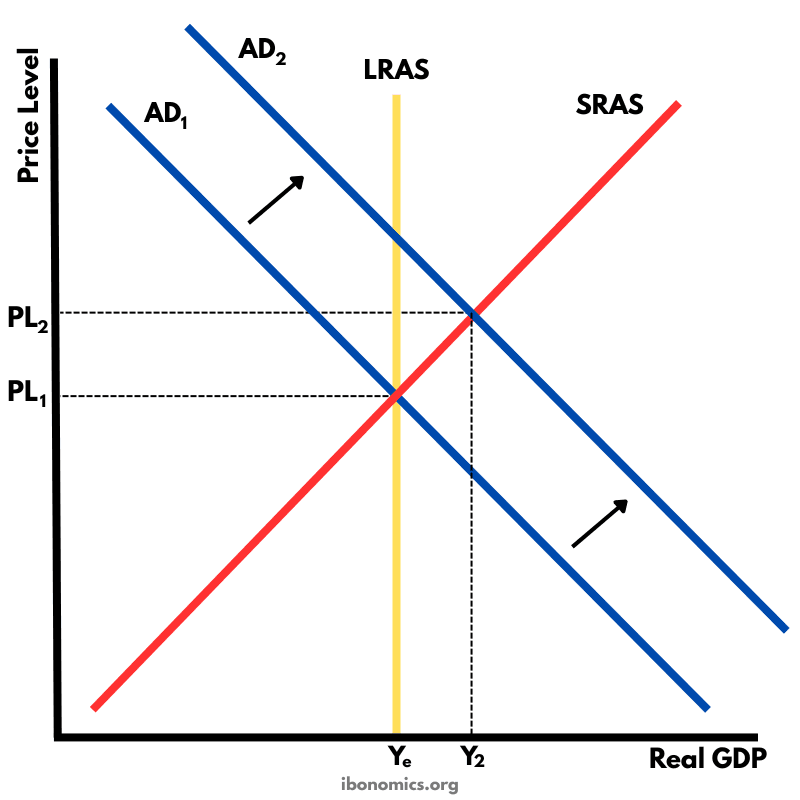

This diagram illustrates how expansionary fiscal or monetary policy shifts aggregate demand (AD) rightward, increasing real GDP and the price level.

AD1: Initial aggregate demand before expansionary policy.

AD2: Aggregate demand after expansionary fiscal or monetary policy.

SRAS: Short-run aggregate supply curve, assumed unchanged.

LRAS: Long-run aggregate supply, vertical at full employment output.

PL1: Initial price level before policy intervention.

PL2: New, higher price level after AD increases.

Y1: Full employment level of output achieved through policy intervention.

Expansionary policy is used to close a deflationary or recessionary gap by increasing aggregate demand (AD).

Initially, the economy is in equilibrium at AD1, SRAS, and price level PL1, with output at full employment (Ye).

A shift to AD2 represents the effect of expansionary fiscal policy (increased government spending or tax cuts) or monetary policy (lower interest rates, increased money supply).

This leads to a new equilibrium with higher output at full employment (Y2) and a higher price level (PL2).

The diagram demonstrates the short-run effects of policy tools on output and inflation.

Explore other diagrams from the same unit to deepen your understanding

A diagram illustrating the fluctuations in real GDP over time, including periods of boom, recession, peak, and trough, relative to the long-term trend of economic growth.

This diagram shows the intersection of the aggregate demand (AD) and short-run aggregate supply (AS) curves to determine the equilibrium price level and real GDP.

A diagram showing the Classical model of aggregate demand (AD), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS), used to explain long-run macroeconomic equilibrium.

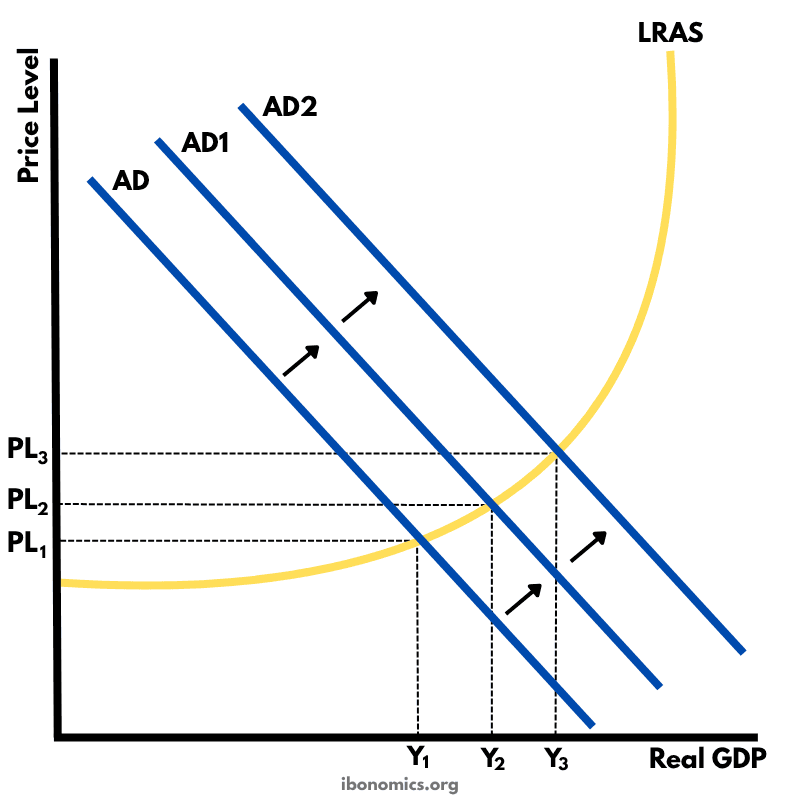

A Keynesian aggregate demand and long-run aggregate supply (AD–LRAS) diagram showing how real GDP and the price level interact across different phases of the economy, including spare capacity and full employment.

A diagram showing an output (deflationary) gap, where the economy is producing below its full employment level of output (Ye).

This diagram shows how an initial increase in aggregate demand leads to a multiplied increase in national output (real GDP) and price level within the Keynesian framework.