Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

Welcome to IBonomics! We are excited to launch and hope you find the website useful! Learn more about us here!

This diagram shows how the equilibrium interest rate is determined in the money market by the interaction of money demand and money supply.

Dm: Downward-sloping demand for money, decreasing with higher interest rates.

Sm: Vertical supply of money, fixed by the central bank.

ie: Equilibrium interest rate where Dm intersects Sm.

Qe: Quantity of money at equilibrium interest rate.

The vertical yellow line (Sm) represents the money supply, which is perfectly inelastic and determined by the central bank.

The downward-sloping blue line (Dm) represents the demand for money, which decreases as the interest rate rises.

The equilibrium interest rate (ie) is where money demand equals money supply, at quantity of money Qe.

Changes in the money supply (shifts in Sm) can be used as a tool of monetary policy to influence interest rates and thus aggregate demand.

An increase in the money supply shifts Sm to the right, lowering the interest rate and stimulating investment and consumption.

Explore other diagrams from the same unit to deepen your understanding

A diagram illustrating the fluctuations in real GDP over time, including periods of boom, recession, peak, and trough, relative to the long-term trend of economic growth.

This diagram shows the intersection of the aggregate demand (AD) and short-run aggregate supply (AS) curves to determine the equilibrium price level and real GDP.

A diagram showing the Classical model of aggregate demand (AD), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS), used to explain long-run macroeconomic equilibrium.

A Keynesian aggregate demand and long-run aggregate supply (AD–LRAS) diagram showing how real GDP and the price level interact across different phases of the economy, including spare capacity and full employment.

A diagram showing an output (deflationary) gap, where the economy is producing below its full employment level of output (Ye).

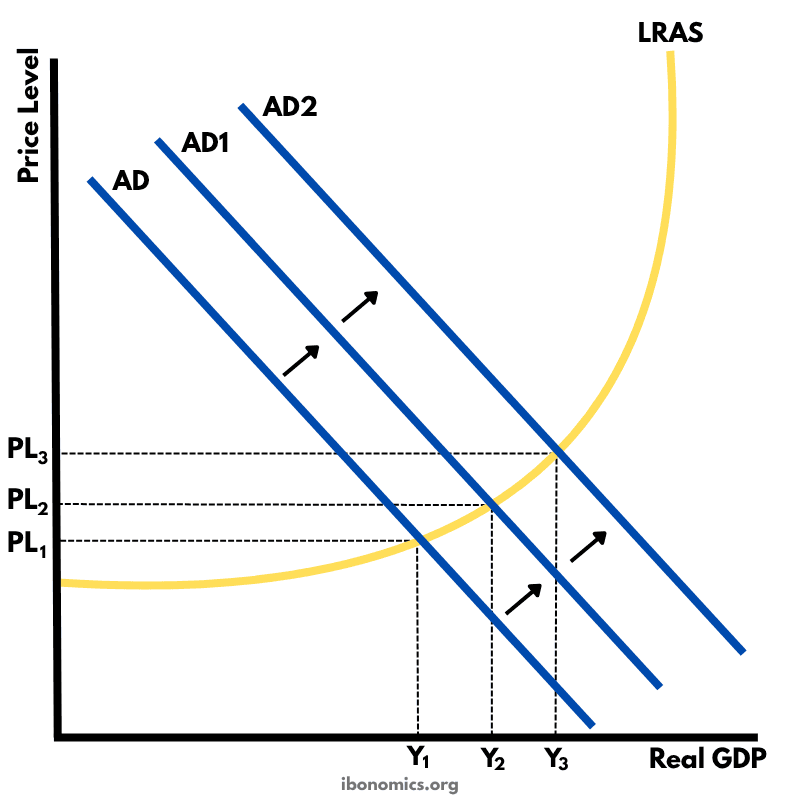

This diagram shows how an initial increase in aggregate demand leads to a multiplied increase in national output (real GDP) and price level within the Keynesian framework.